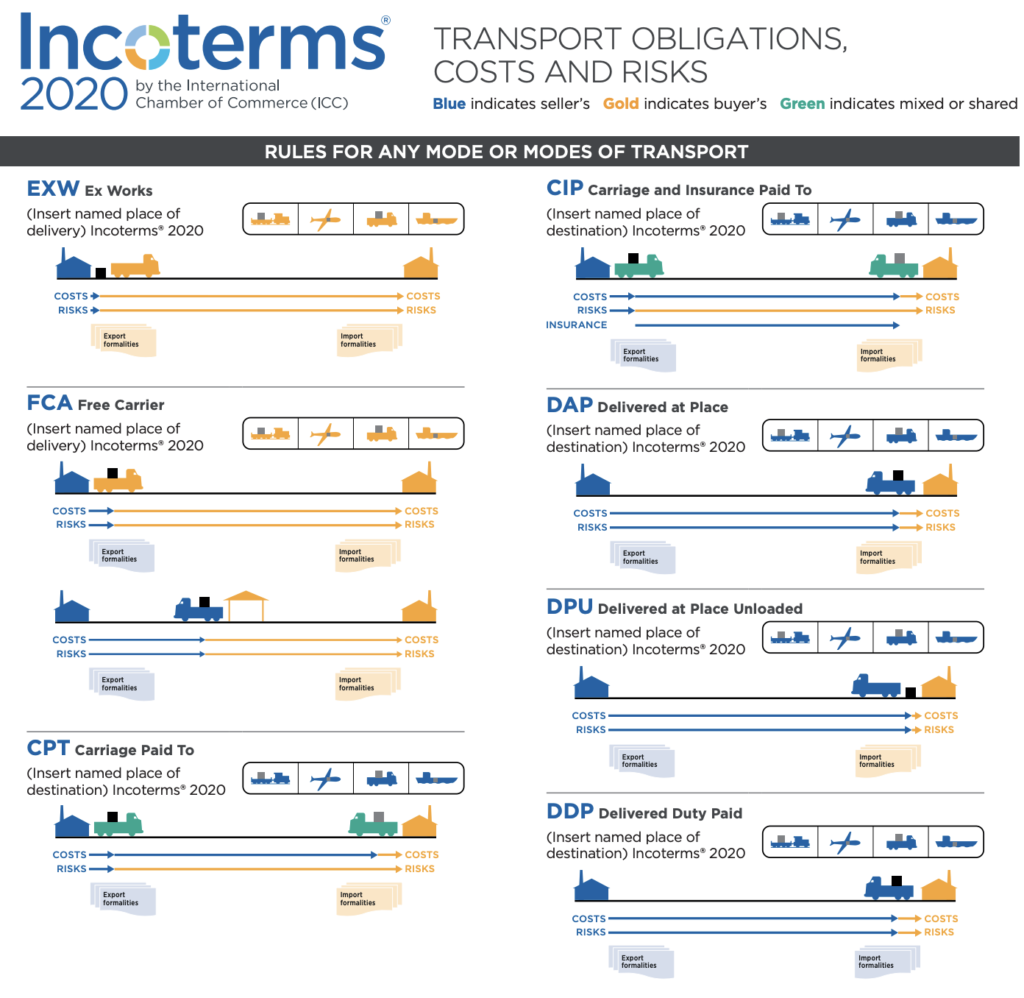

Incoterms 2020 Rules Guide for Imports from China

What are Incoterms?

Incoterms stands for International Commercial Terms. Incoterms are a codified set of standard contractual provisions relating to the carriage of goods.

Defined since 1936 by the International Chamber of Commerce (ICC), Incoterms are revised every 10 years to reflect changes in international trade practices.

These customary rules define in a codified manner the conditions of delivery of goods under a sales contract.

More specifically, Incoterms make it possible to determine the conditions of delivery of goods sold: assumption of transport, insurance, customs formalities, duties and taxes, customs clearance obligations, transfer of risks.

The Incoterms 2020 reform

Coming into force on 1 January 2020, the new version, like the previous one, is made up of 11 Incoterms, still classified into two groups according to the mode of transport of the goods.

Incoterms EXW

- EXW – Ex Works

The rule which imposes the least obligations on the seller, whose sole responsibility is to pack the goods and make them available to the buyer at his own premises. Under this rule, the buyer bears all costs and risks involved in loading and transporting the goods to their destination.

As the buyer is responsible for customs formalities on export, he may encounter difficulties in the seller’s country in obtaining proof of exit of the goods.

Incoterms FOB

- FOB – Free On Board

The transfer of costs (and risks) takes place as soon as the goods are loaded on board the vessel designated by the buyer at the agreed port of shipment.

Thus, unlike the FAS, the loading of the vessel is the responsibility of the seller.

For more information on the FOB Incoterm.

Incoterms CFR and CIF

- CFR – Cost and Freight

Like the multimodal C-rules, the transfer of risks and costs is unbundled. The risks are transferred to the buyer at the port of departure when the goods are delivered on board the ship, whereas the costs are borne by the seller under the contract of carriage until the arrival of the goods at the agreed port of destination, not including discharge.

Thus, as a matter of principle, the costs of discharging the ship are borne by the buyer, as are the resulting handling charges, unless the contract of carriage provides otherwise.

For more information on the CFR Incoterm.

- CIF – Cost Insurance and Freight

The equivalent of the multimodal CIP, the maritime CIF differs from it in the level of insurance cover required, which is more limited than the all-risk cover of the CIP.

Nevertheless, the insurance must cover at least the price of the goods plus 10%.

For more information on the CIF Incoterm.

Incoterms DAP and DDP

Under the Incoterms D rules, since delivery is made in the country of destination, the transfer of risk takes place there.

Under these so-called “Incoterms on arrival”, the goods travel at the risk of the seller who assumes all risks and costs associated with the transport of the goods to the place of destination.

- DAP – Delivered At Place

This Incoterms means that goods are considered delivered when they are made available to the buyer at destination on the arriving means of transport, without being unloaded. According to this rule, the seller is responsible for transporting the goods to the agreed delivery point in the country of destination.

Thus, unless the contract of carriage provides otherwise, the buyer is responsible for customs formalities, the payment of duties and taxes due on account of the import and the unloading of the goods at destination.

For more information on the DAP Incoterm.

- DDP – Delivered Duty Paid

Règle Incoterms qui confère le niveau maximal d’obligations au vendeur, qui assume tous les risques et frais, y compris de dédouanement, jusqu’au lieu convenu.

Ainsi, en vertu de cet Incoterms, les marchandises sont livrées dédouanées, prêtes à être déchargées au lieu de destination.

Seuls les frais d’assurance et de déchargement à destination sont à la charge de l’acheteur.

For more information on the DDP Incoterm.

Sample Incoterms 2020 — Buyer’s Point of View

You are the BUYER and —

1. You wish to receive the goods directly at your place of business or other point in the country of destination, and you are unwilling to accept any transport risks. You must choose an ‘arrival’ contract (see above). Are you willing to carry out import clearance formalities?

a) If No:

Choose DDP, which gives the seller total responsibility up to delivery at the buyer’s premises or the named delivery point if the shipment is containerized or multimodal, or delivery is to be made to an inland or port terminal. But note that practical realities may prevent a seller from being able to undertake import clearance, so choose this rule with caution. See the Explanatory Note for DDP in the text of the Incoterms 2020 rules (ICC Publication No. 723E).

b) If Yes, you may use:

i) DAP which imposes upon seller total transport responsibility and risk, except as regards import clearance formalities and duties, which are for the buyer’s account. Note that DAP differs from DPU in that DAP does NOT require the seller to unload the goods at destination; or

This Incoterms means that goods are considered delivered when they are made available to the buyer at destination on the arriving means of transport, without being unloaded. According to this rule, the seller is responsible for transporting the goods to the agreed delivery point in the country of destination.

Thus, unless the contract of carriage provides otherwise, the buyer is responsible for customs formalities, the payment of duties and taxes due on account of the import and the unloading of the goods at destination.

Frequently Asked Questions

What is the most commonly used incoterm?

CFR (Cost and Freight): the seller bears the cost and freight until arrival at the named port, including export clearance. However, the risk is transferred to the buyer when the goods are loaded onto the vessel. This Incoterm is only used for sea transport.

What are the 4 families of Incoterms?

They are classified by type of transport (there are 4 maritime incoterms) and by order of increasing obligation for the seller. A distinction must be made between sale on departure and sale on arrival. The Incoterms for outbound sales are as follows: EXW, FOB, CFR, CIF.

How to easily understand Incoterms?

It is a series of three-letter terms. These terms reflect the allocation of costs (e.g. transport costs) and risks between the parties. They therefore define certain obligations, costs and risks involved in the transfer of a product.

What is the difference between DAP and DDP?

The DDP Incoterm differs from the DAP Incoterm in the settlement of customs and tax costs. Indeed, if the delivery is based on the DAP Incoterm, the transport costs are borne by the seller. However, the buyer must pay the import taxes.

Why choose FOB?

Why choose the FOB incoterm? This is a transport mode applicable only to maritime transport. It is an incoterm of sale on departure, i.e. the risks are for the buyer from the moment the goods are loaded on the ship.

What is the difference between FOB and CIF?

With the CIF Incoterm, the seller’s insurance will be called upon in the event of an incident during transport. The FOB Incoterm, on the other hand, defines greater liability shares for the buyer. The buyer is responsible for the transport of the goods and for taking out marine insurance.

Why use the EXW Incoterm?

EXW also has certain advantages for the buyer: since the buyer is responsible for transport and formalities, he has full visibility of the delivery process. He can therefore better control the goods and the progress of their delivery.

What is the main purpose of Incoterms?

The purpose of these agreements is to regulate: the distribution of costs related to the transport of goods; the transfer of risks during the transport of goods.