Freight Rates Plummet on Europe-Mediterranean Routes!

As the China National Day Golden Week approaches, weak demand has prompted shipping companies to fear another plunge in spot container freight rates. In response, they have canceled several export sailings from Asia to Europe and the U.S., adjusting their capacities.

According to the latest assessment report from Drewry, between September 2 and October 6, 2024, major East-West trade lanes—specifically the Trans-Pacific, Trans-Atlantic, and Asia-North Europe and Mediterranean routes—have already announced the cancellation of 68 sailings. These cancellations account for 10% of the planned 696 sailings. Among the canceled sailings, approximately 51% are on the Trans-Pacific route, 28% on the Asia-North Europe and Mediterranean routes, and 21% on the Trans-Atlantic route.

Drewry also pointed out that over the next five weeks, the OCEAN Alliance, THE Alliance, and the 2M Alliance have respectively canceled 12, 17, and 10 sailings, with 29 sailings canceled by non-alliance carriers.

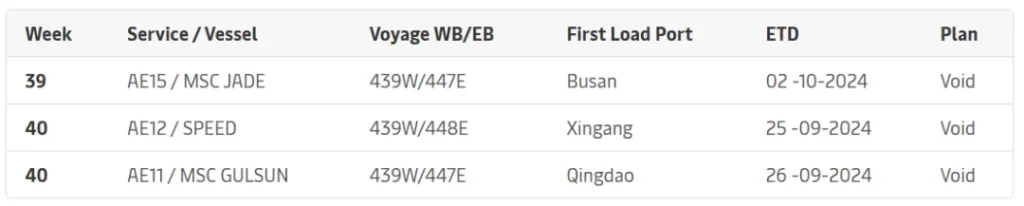

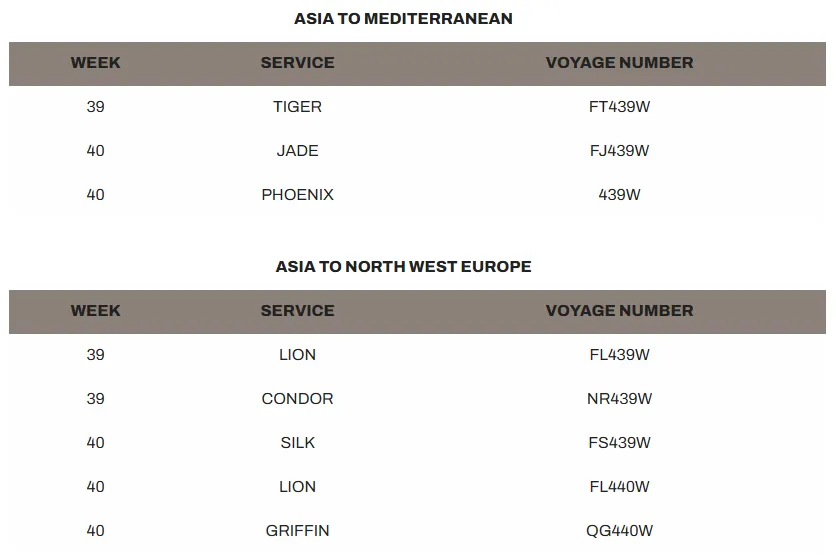

In its latest announcement, 2M Alliance member Maersk stated that it anticipates a decrease in demand and is seeking network balance. Below is Maersk’s blank sailing schedule for the Far East to Europe and Mediterranean routes: 👉

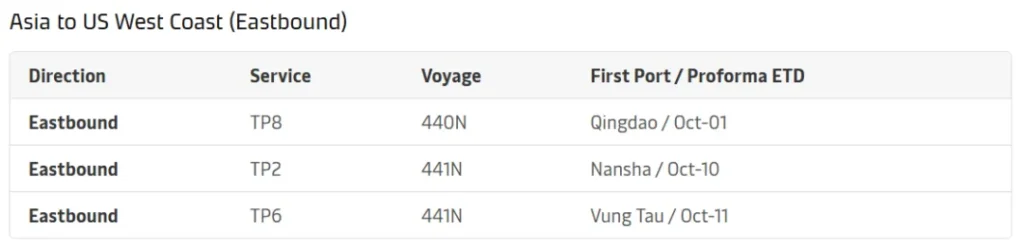

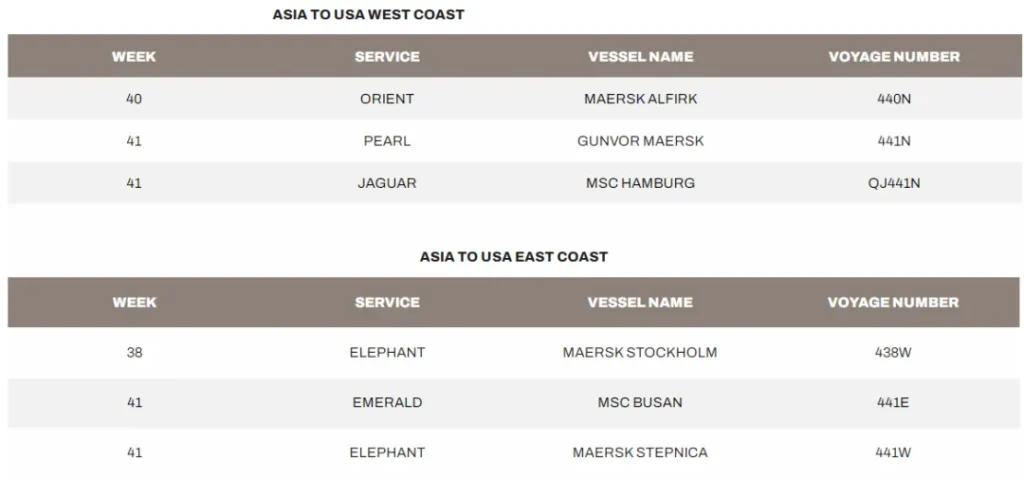

Below is Maersk’s schedule adjustment for the Asia-West Coast U.S. and Asia-East Coast U.S. routes, with the following sailings being blanked: 👉

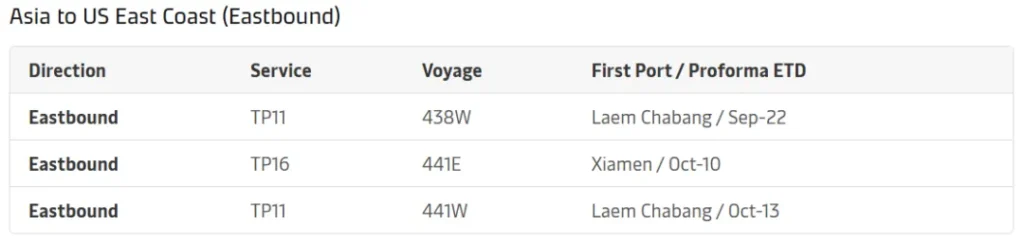

The other member of the 2M Alliance, Mediterranean Shipping Company (MSC), also announced that due to the anticipated slowdown in demand, it will adjust its Asia-Europe route services in Week 39 and Week 40. The following sailings will be canceled: 👇 (From MSC)

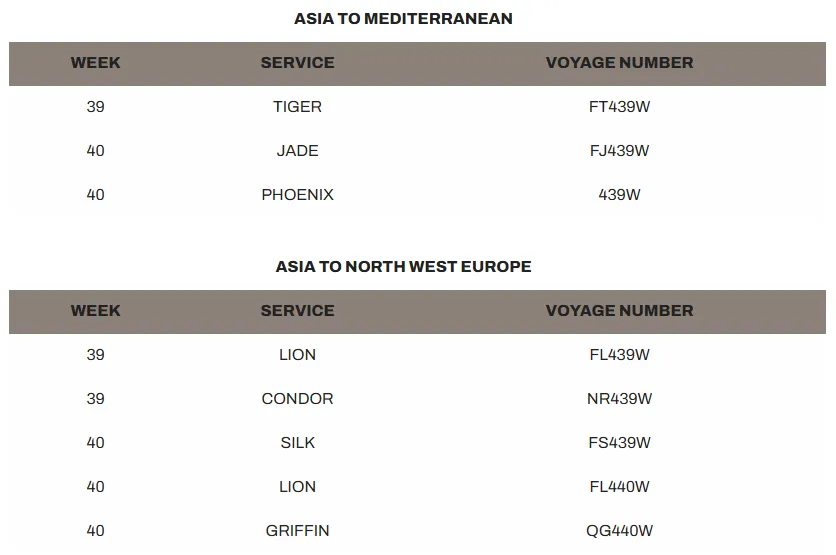

MSC also plans to adjust its Asia-to-U.S. route services for Weeks 38 through 41, with the following sailings being canceled: 👇 (From MSC)

Although spot freight rates from Asia to Europe and on eastbound Trans-Pacific routes have been gradually declining for several weeks, there is no evidence so far that major shipping companies will significantly reduce prices, leading to a freight rate collapse. Drewry’s WCI Asia-North Europe Index remains about 350% higher than 12 months ago, currently at $7,204 per 40FT container, down 3% this week.

On August 30, the freight rates (including ocean freight and surcharges) for exports from Shanghai Port, China, to major ports in Europe and the Mediterranean were $3,876/TEU and $4,083/TEU, respectively, down 11.9% and 9.7% compared to the previous period.

The market freight rates for the U.S. East Coast and West Coast routes showed slight divergence, with a small increase on the West Coast route and a continued decline on the East Coast route. On August 30, the freight rates for exports from Shanghai Port to the U.S. West Coast and East Coast major ports (including ocean freight and surcharges) were $6,140/FEU and $8,439/FEU, respectively, with a 3.1% increase and a 1.3% decrease compared to the previous period.

Although shipping companies have deployed effective capacity on the Trans-Pacific route, small new entrants to the market are eroding freight rates, and demand is weakening. However, the looming threat of an East Coast port strike in the U.S. in October and the introduction of new import tariffs are expected to support freight rates on this route.