Analyse the potential far-reaching effects of the Canadian rail strike/lockout

1. Likely Full Shutdown of Canadian Railways on August 22:

- On August 22 at 01:00 AM, Canada’s two major Class I railways, CN (Canadian National) and CPKC (Canadian Pacific Kansas City), are expected to face a complete shutdown (in practice, operations are already gradually closing). This is not a sudden event; it was a potential issue anticipated since July. Both the labor unions and the employers have made threats: unions have warned of strikes, while the employers have announced a lockout if a strike occurs.

2. Notices and Timeline:

- CN and CPKC have issued 72-hour shutdown notices to the TCRC (Teamsters Canada Rail Conference) union. The potential strike and lockout are set to start at 01:00 AM on August 22. The TCRC union has also issued a 72-hour strike notice, planning to strike on Thursday morning.

3. Impact on Canadian Ports:

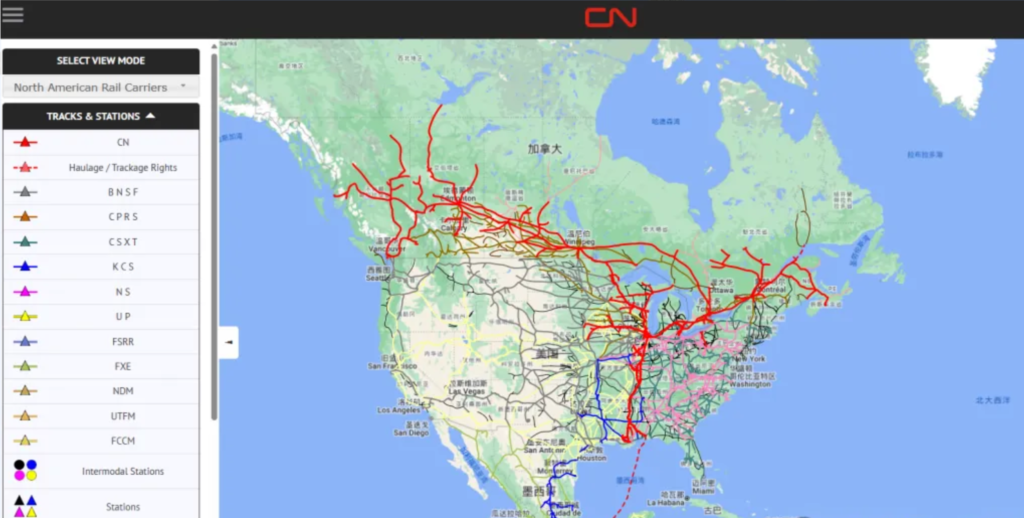

- The west coast ports of Vancouver and Prince Rupert will be most affected due to their reliance on rail transport. CN services Prince Rupert, with most goods transported by rail inland, and at least half of Vancouver’s cargo volume is also rail-dependent. If a strike occurs, shippers may explore alternatives such as transferring cargo to long-haul trucks or paying trucking companies to move containers to Seattle, where they can then be transported by BNSF Railway or Union Pacific Railroad. C.H. Robinson has indicated it is shifting some US customers’ sea freight from Canadian ports. Approximately 80% of the redirected cargo is now being shipped through the Los Angeles/Long Beach ports, with the remainder going through Seattle/Tacoma ports.

4. Increased Congestion at Seattle-Tacoma Ports:

- US import volumes have surged, and the shift of Canadian cargo is expected to further exacerbate congestion in the region. The peak season for trans-Pacific shipping arrived early this year, prompting shipping companies to add or restore three new routes between Asia and the Pacific Northwest. Data from S&P Global’s sister company PIERS shows a staggering 51% year-on-year increase in imports through the Northwest Seaport Alliance (NWSA) ports of Seattle and Tacoma in July, following increases of 29% in June and 22% in May.

5. Container Line Warnings:

- Container lines calling at Tacoma are warning of further extended rail congestion and vessel schedule adjustments due to surging import volumes and a shortage of intermodal railcars. Hapag-Lloyd reports severe railcar shortages leading to increased dwell times for imports, with no significant improvement expected in August. ONE also reports severe import rail congestion at Tacoma’s terminals affecting vessel operations.

6. Seattle and Tacoma Ports:

- Seattle and Tacoma are relatively close, located in Washington state’s Puget Sound area, about 30 miles (48 kilometers) apart. These two ports are managed together through the Northwest Seaport Alliance (NWSA), which aims to optimize operations and competitiveness, allowing closer collaboration in freight and logistics. Both ports have rail connections and intermodal capabilities. UP (Union Pacific Railroad) and BNSF Railway serve the NWSA, but the rail congestion issues are concentrated at Tacoma’s terminals served by UP, including Husky Terminal and Washington United Terminal. Congestion has been intermittent for months, impacting freight services.

7. Terminal Wait Times:

- As of August 19, wait times at Tacoma’s Husky Terminal can extend up to 13 days, and at Washington United Terminal up to 8 days. Seattle’s terminals have wait times of around 5 days. Extended wait times are due to high import rail cargo volumes and a shortage of railcars. Husky Terminal’s average import rail container dwell time is 5.8 days, Washington United Terminal is 9.6 days, and some locations may experience dwell times of up to 14 days. To alleviate Tacoma’s import rail issues, certain vessels are temporarily docking at Seattle’s T18 Terminal for loading and unloading.

8. Shutdown Preparations:

- CN and CPKC have begun gradually shutting down operations in preparation for a possible work stoppage on Thursday, with negotiations for a new collective agreement covering over 9,000 train crew members and engineers making little progress. CN has stopped accepting intermodal freight, and CPKC will cease accepting intermodal business on Tuesday. US Class I railroads have also temporarily closed all freight routes to Canada.

9. Broader Implications:

- A shutdown of Canadian railways will have far-reaching impacts. Annually, over 250,000 sea and domestic containers move between Vancouver and Toronto, and another 125,000 between Montreal and Toronto. The disruption will also affect the US, with approximately 50,000 containers moving from Vancouver to Chicago. CN and CPKC have issued shutdown notices, meaning they will no longer adhere to previous collective bargaining agreements. The TCRC union has also issued a strike notice.

10. Maersk’s Response:

- Maersk announced it will suspend the acceptance of some cargo destined for Canada until further notice. For cargo already en route to Vancouver and Prince Rupert, there are options for forwarding it to destination ports. Importers can transport goods from receiving ports via truck to cross-docks where they can be loaded into trucks and transported by road. Cargo destined for Vancouver can also be trucked to Seattle for subsequent transport via BNSF or Union Pacific railroads to Chicago, although Tacoma’s terminals are experiencing rail congestion due to redirected cargo.

11. Impact Outside Canada:

- Shippers using CN and CPKC outside Canada will not experience service interruptions. CPKC’s service between Mexico and Chicago will operate normally, as no Canadian staff are involved. CN’s partner services, such as Falcon Premium between Mexico and Detroit, and all CN routes in the US will continue to operate.

12. Retail Concerns:

- The Canadian Retail Association warns that with the back-to-school and holiday seasons approaching, this disruption could lead to empty shelves nationwide. The Retail Council of Canada (RCC) is increasing pressure on the government to intervene and prevent a disruptive and problematic shutdown. Members are urged to share potential impacts with RCC to strengthen advocacy efforts.

13. C.H. Robinson’s Actions:

- C.H. Robinson has begun shifting some US customers’ sea freight from Canadian ports due to the imminent threat of a rail strike. Approximately 80% of the redirected cargo is now being shipped through the Los Angeles/Long Beach ports, with the remainder through Seattle/Tacoma ports. C.H. Robinson is arranging additional truck transport capacity on both sides of the border, as the disruption is expected to shift freight to road transport. This impending strike, starting as early as August 22, is causing uncertainty for shippers in both the US and Canada, forcing them to consider road transport options.