Will the freight rates increase or start to decrease?

Global shipping is once again facing surging freight rates, port congestion, and container shortages, tightening the nerves of the global supply chain!

The COVID-19 pandemic once caused a supply chain disruption crisis, and now new challenges have suddenly arisen. Port congestion, soaring freight rates, along with the multiple impacts of geopolitical and climate factors, are adding new uncertainties to global shipping and supply chain stability.

From the threat of Houthi attacks on shipping vessels, to restrictions on passage through the Panama Canal due to drought, to the strike threats from workers on the U.S. East Coast, German ports, and Canadian railways, the global supply chain is under unprecedented pressure.

According to Xeneta data, freight rates from Asia to Europe have skyrocketed from $1,200 to over $7,000.

Freight rates on Pacific routes are also rising significantly.

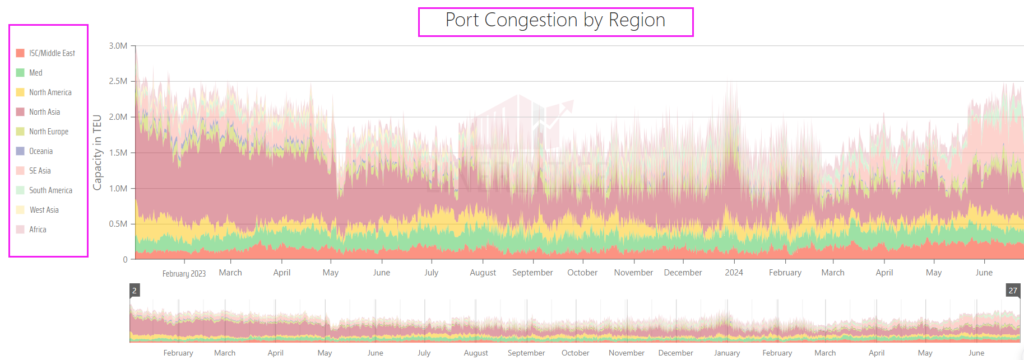

Although this is lower than the peak of $15,000 at the end of 2021 when the supply chain disruption was at its worst, it is still five times the pre-pandemic rates. Besides the sharp cost increase, port congestion has also become a significant problem. In addition to the Red Sea crisis, shippers and research firms indicate that this year’s peak shipping season has arrived earlier than expected, exacerbating port congestion.

Maritime data company Linerlytica reported this month that global port congestion has reached its highest level in 18 months, with 60% of the vessels anchored in Asia. As of mid-June, vessels with a total capacity of over 2.4 million TEU (twenty-foot equivalent units) were waiting at anchorages.

The Port of Singapore is perhaps the most notable among the many congested ports. Singapore is the world’s second-largest container port, and in recent weeks, it has experienced particularly severe congestion. Typically, container ships do not stay at this port for more than a day.

At the end of May this year, the Maritime and Port Authority of Singapore (MPA) revealed that the average waiting time for container ships to berth had reached two to three days. Container tracking companies Linerlytica and PortCast indicated that the berthing delays for container ships might have extended to as long as a week.

According to Reuters, “the congestion at the Port of Singapore is the worst since the COVID-19 pandemic,” indicating that ships rerouting to avoid Red Sea attacks have disrupted global shipping, causing bottlenecks at other Asian and European ports as well.

"Congestion at Singapore’s container port is at its worst since the COVID-19 pandemic, a sign of how prolonged vessel re-routing to avoid Red Sea attacks has disrupted global ocean shipping – with bottlenecks also appearing in other Asian and European ports."

Given the severe congestion at the Port of Singapore, neighboring Asian ports are experiencing increased traffic. Linerlytica pointed out that the shipping pressure has shifted to Malaysia’s largest port, Port Klang, and Tanjung Pelepas Port. Drewry expects congestion at major transshipment ports to remain high but predicts some relief as carriers add capacity and restore schedules.

Meanwhile, waiting times at Chinese ports are also increasing, with Shanghai and Qingdao experiencing the longest delays. The U.S. is set to impose significant tariffs on a large number of Chinese export goods starting August 1, and many U.S. importers are rushing to purchase Chinese goods before the new policy takes effect, which may be contributing to the bottlenecks at Chinese ports.

The Maritime and Port Authority of Singapore indicated that port operator PSA has reopened the older berths and terminals at Keppel Terminal and will open more berths at Tuas Port to address the extended waiting times. Port congestion has already affected the shipping schedules of carriers.

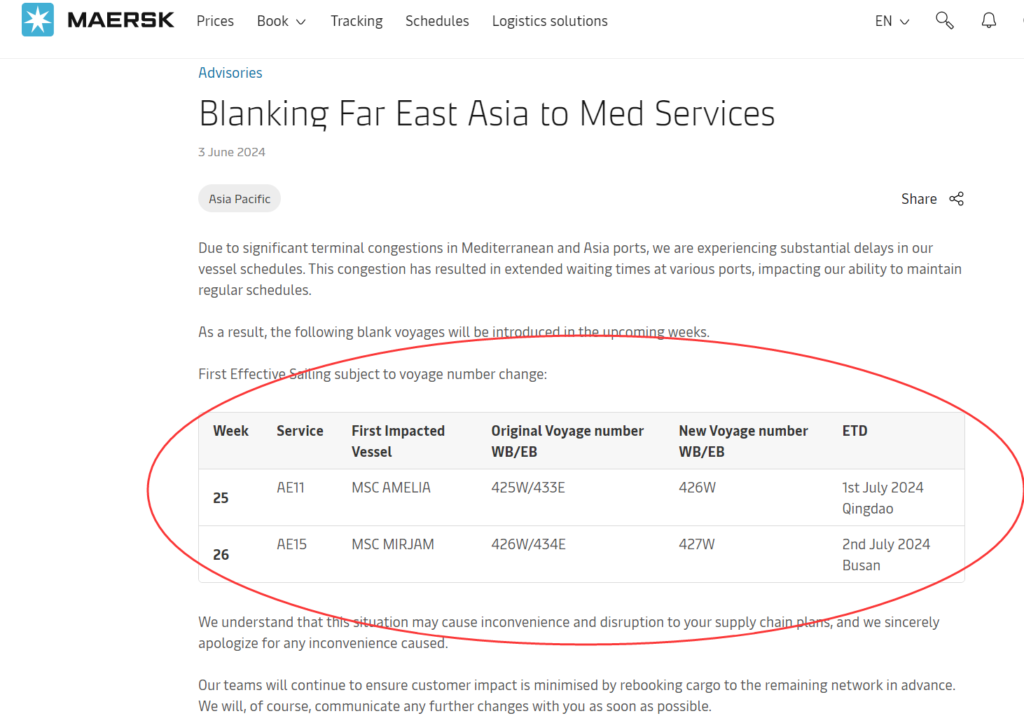

Maersk, the world’s second-largest container shipping company, announced this month that due to severe congestion at ports in Asia and the Mediterranean, it will cancel two westbound sailings from China and South Korea in early July. Maersk stated, “Due to severe terminal congestion in Mediterranean and Asian ports, our schedules are significantly delayed. This congestion is extending waiting times at various ports, affecting our ability to maintain normal schedules.”

Faced with such a complex market, the pressure on foreign trade exporters, consignees, sellers, and freight forwarders is indeed substantial. If you have shipments to arrange, it is advisable to plan ahead to be prepared for any contingencies.