What are the main issues that the U.S. is targeting with the T86 clearance?

Entry Type 86 (hereinafter referred to as “T86”) is an electronic customs clearance mode established under Section 321 of the U.S. Code, known as the “de minimis exemption.” It exempts all packages with a total daily import value of ≤ $800 per person from customs duties. This policy also applies to business importers.

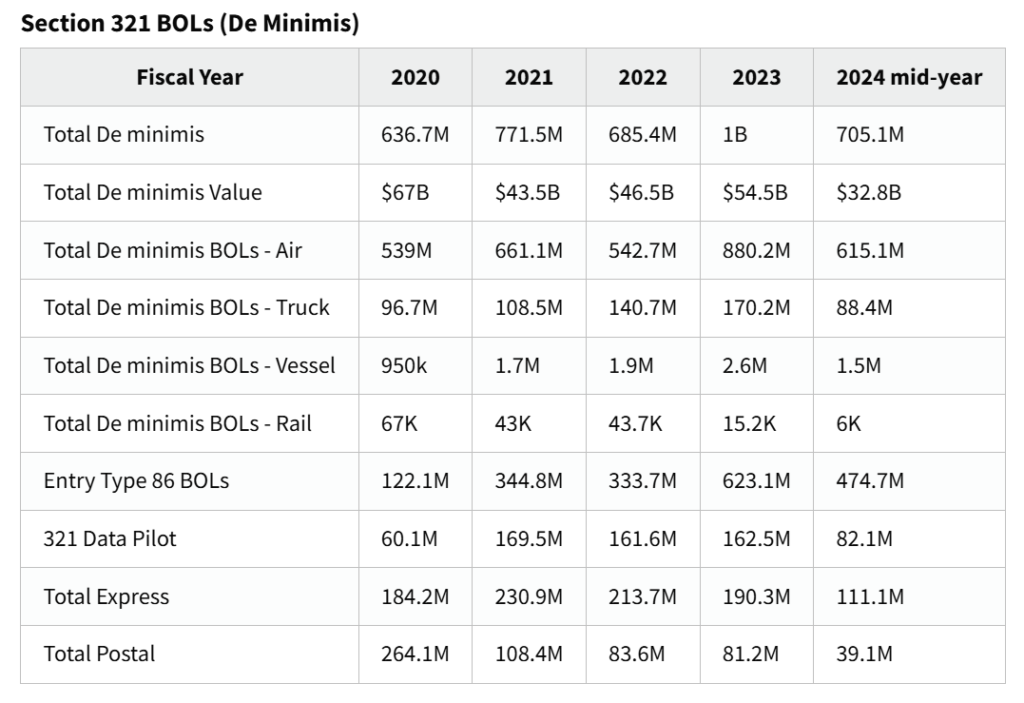

Since 2020, there has been an explosive increase in the volume of duty-free imported packages in the United States. The advent of T86 has significantly reduced clearance times but has also provided opportunities for unscrupulous individuals, leading to a large influx of non-compliant packages. This has undoubtedly placed tremendous regulatory pressure on customs officers at ports of entry.

The current T86 customs clearance mode is still in the testing phase. U.S. Customs and Border Protection (hereinafter referred to as “CBP”) is working to apply the test results to the formulation of new clearance policies. Before the new policies are released, CBP needs to collect more effective data. To this end, CBP has been taking rectification measures intermittently, primarily to regulate and identify three issues:

- Where the goods are coming from?

- What goods are being shipped?

- Where the goods are being sent?

However, despite these seemingly simple questions, CBP faces numerous challenges from traders that repeatedly impact clearance efficiency. The common issues are categorized as follows:

1)Abuse of Duty-Free Policy by Breaking Down Shipments

In simple terms, splitting a single transaction with a total value exceeding $800 into multiple packages to import them into the United States to avoid taxes is against regulations. In the future, CBP will use digital technology to strictly monitor the cumulative daily import value of packages for individual importers. Packages found in violation will not be able to clear customs under the T86 mode.

2)Concealed Declarations (Discrepancies between Documents/Goods, Mismatched Declared and Actual Quantities)

According to U.S. federal regulations, all imported goods must ensure that the import documents, declared names of goods, declared quantities, and related import qualifications match the actual items. Concealing or underreporting is a violation. Once discovered, CBP will issue fines of $5,000 per package. In severe cases, violators may also face legal liability.

3)Vague Product Descriptions

According to data released by CBP, 26.8 million packages in 2023 had issues with vague product descriptions, and the first half of 2024 has already seen 13.488 million such packages. This has drawn significant attention from CBP, which has since issued a list of prohibited vague product descriptions. In the future, the customs system will reject such data declarations and require product transaction links or images.

For example, product descriptions like “Daily necessities,” “Parts,” “Accessories,” “Equipment,” or “Gift” do not provide customs officers with a clear understanding of the items being shipped.

“Accessories” could refer to jewelry accessories, car parts, or various components, each with significantly different customs codes (HTS). As a result, customs officers have to manually inspect the packages.

Therefore, to expedite clearance, more detailed, accurate, and specific product descriptions should be used, enabling customs to quickly identify the product’s purpose and material, such as “Earrings,” “Necklace,” “Car holder,” “Women’s leather belt,” etc.

For more details on the list of prohibited vague product descriptions, please refer to the link: CBP Vague Product Descriptions List.

4)Low-Quality Recipient Information

Vague recipient information is also a significant issue. Statistics show that cases of using various virtual names or cartoon characters as recipient names are common. This lack of genuine importer information makes it difficult for CBP to effectively monitor whether the recipients meet the duty-free import conditions, which may lead to packages being inspected or detained. In practice, sellers should ensure that the recipient information on their orders includes accurate full names (at least two words).

5)Invalid/Incorrect Recipient Addresses/ZIP Codes

Invalid or incorrect addresses can also lead to similar inspection and detention issues. Even if CBP conducts an on-site package inspection, unresolved discrepancies can prevent the package from clearing customs smoothly. Therefore, it is crucial to ensure that recipient addresses and ZIP codes are accurate and valid to avoid delays in customs clearance.

6)Price-Value Mismatch

The ratio of product weight to value is another issue of concern for customs. For example, if a T-shirt is declared with a weight of 1 kg and a value of $0.5, this is clearly inconsistent with reality and increases the likelihood of inspection and interception.

Since the beginning of this year, CBP has made some progress in regulating declarations by suspending the T86 clearance qualifications of certain brokers. However, our company believes this is just the beginning, and future policies will gradually tighten. Instead of being passively affected, we encourage sellers to proactively prepare for the stable and healthy development of their businesses.

To this end, we suggest the following:

Accurate Declarations: Ensure all product descriptions, quantities, and values are accurate and truthful.(Note: Duty-free import limits vary by country, so adhere to the specific requirements of each country’s import documents.)

Detailed Recipient Information: Provide complete and accurate recipient names and addresses.

Compliance with Regulations: Stay informed about and comply with CBP regulations and guidelines.