Maersk announces an increase in FAK rates for the European route! Freight rates rise to nearly $10,000!

Frontline’s CEO, Lars Barstad, said on Wednesday that even if the Israel-Palestine conflict reaches a ceasefire, which could potentially end the threat of Houthi attacks on ships, shipping companies are unlikely to quickly resume routes in the Red Sea.

Lars Barstad emphasized, “We are all hoping for a ceasefire in the Israel-Palestine conflict, but expecting shipowners to risk sending crews through the Red Sea or the Gulf of Aden is undoubtedly too optimistic.” He further stated that there is no conclusive evidence that the Houthi rebels in Yemen would stop attacking ships after a ceasefire in the Israel-Palestine conflict.

Since November of last year, Yemen’s Houthi rebels have launched attacks on ships passing through the Red Sea, forcing major shipping companies to reroute around the Cape of Good Hope in Africa. This measure has significantly increased shipping costs and led to a notable rise in the stock prices of shipping companies. However, after the UN passed a resolution on Monday regarding a ceasefire in the Gaza Strip, the stock prices of major container shipping giants have fallen. Both Maersk and Hapag-Lloyd have seen their stock prices drop by 6% since Monday.

At the TOC Europe 2024 conference this week, Xeneta’s Chief Analyst, Peter Sand, warned that spot freight rates are expected to rise further. This increase is primarily driven by the Red Sea crisis, port congestion, and a surge in demand due to the threat of a tariff war. Although there are concerns that a resurgence in demand similar to the pandemic could prompt shippers to act in advance, the expected rate increase in mid-June might be relatively small, it still poses a significant challenge for shippers.

Vespucci Maritime’s CEO, Lars Jensen, pointed out that container trade has returned to pre-pandemic levels, and the excess capacity in the industry following the Red Sea crisis is a temporary phenomenon. With the surge in demand, severe congestion has appeared at ports in Singapore and the Western Mediterranean, similar to what was experienced during the pandemic. The recent spike in vessel charter costs also suggests that carriers and shipowners expect these issues to persist.

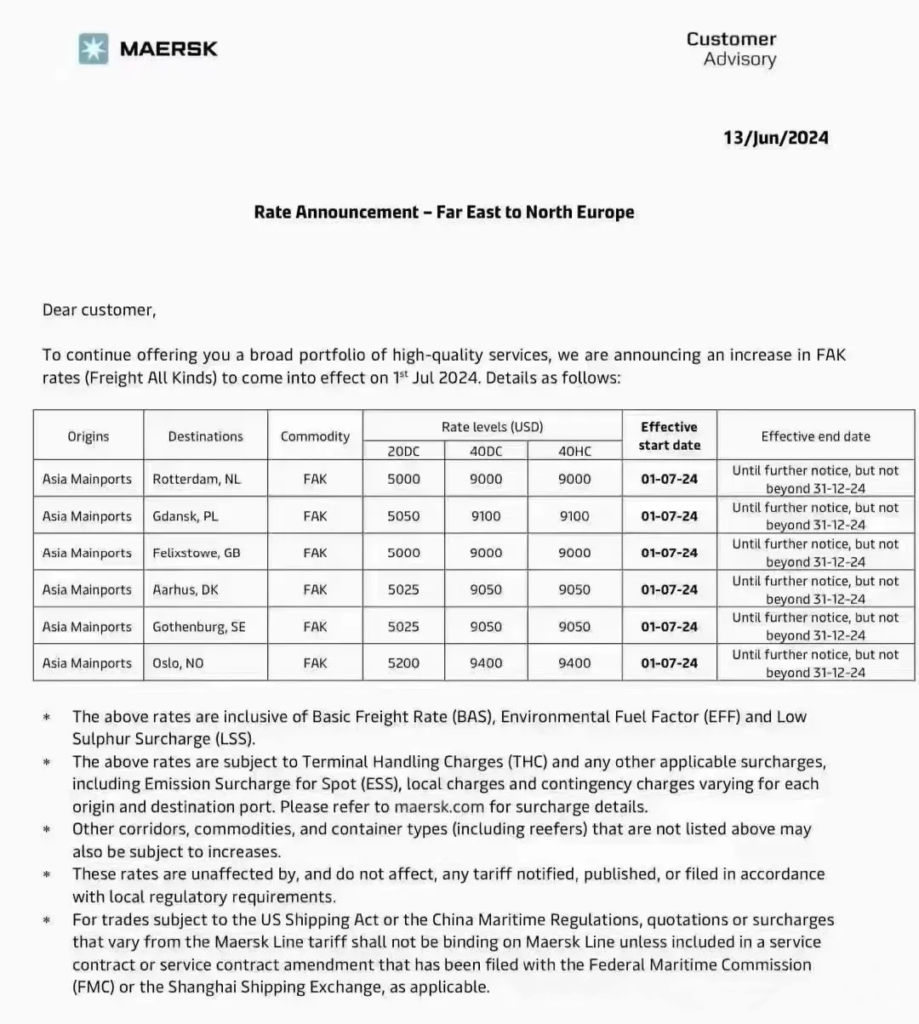

Meanwhile, the maritime market continues to show an upward trend. On June 13th, Maersk announced an increase in FAK rates for the Asia-Europe route, with the highest rate rising to $9,400 per FEU. This adjustment will take effect on July 1st. The market widely expects other major shipping companies to follow suit with similar rate adjustments.