A well-known shipping company breaches contract, cargo owner claims $12 million in compensation.

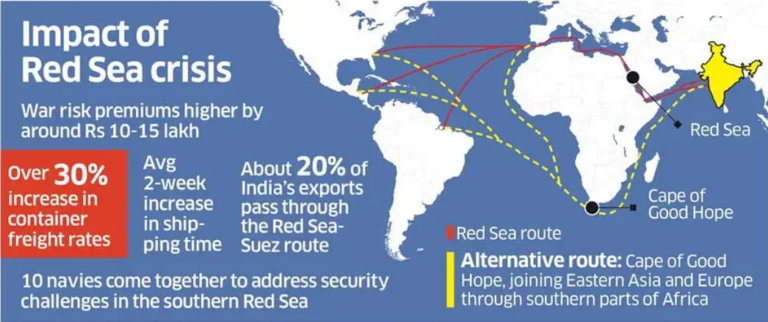

Since the beginning of this year, shipping prices have skyrocketed, leading to a phenomenon where containers are in extremely short supply. Due to the high demand, shipping companies have also started releasing cargo space through alternative methods.

Recently, an American furniture dealer, PKDC, filed a lawsuit with the Federal Maritime Commission (FMC), seeking $12 million in compensation from French shipping giant CMA CGM. The dealer claims that CMA CGM’s failure to provide the agreed-upon number of containers as stipulated in the contract forced them to seek alternative shipping solutions, resulting in over $12 million in additional transportation and transshipment costs. Despite breaching the contract, CMA CGM continued to sell cargo space to PKDC at higher prices.

In PKDC’s lawsuit, there is a statement that resonates with many shippers, reflecting a situation that numerous cargo owners have experienced firsthand.

“Although the carrier refused to transport the goods according to the contract, the same cargo appeared on CMA CGM’s ships after purchasing cargo space at a higher price.”

Encountering such unfair treatment can indeed provoke anger among many cargo owners. However, most shipping companies operate in a manner that is tacitly accepted by the majority of cargo owner companies, which rely on these companies for exporting goods via sea transportation.

However, PKDC has taken a different approach by citing a series of unreasonable actions by CMA CGM in their complaint. Apart from the breach of contract and price hikes, PKDC also alleges issues with CMA CGM’s fee policies. Between August and November 2022, PKDC paid approximately $1 million in demurrage and detention fees, which, according to PKDC, were incurred due to CMA CGM’s own insufficient space, and thus should not be borne by the shipper.

One after another, the “evidence” is pushing CMA CGM into the spotlight. It’s worth noting that another transportation company, Access One Transport, has also filed a claim against CMA CGM for approximately $77,000 due to issues with returning empty containers. This series of disputes undoubtedly will impact CMA CGM’s reputation and market position.

Cargo owners are having a tough time

Cargo owners are facing dire circumstances. As the shipping industry enters its peak season, freight companies often engage in a practice known as “container rolling” to ensure vessels are fully loaded. Once vessels are overloaded, they reject loading goods from shippers with lower freight rates or weaker relationships, delaying their shipments to subsequent voyages.

Direct victims include shippers, cargo owners, and freight forwarders, who may face delivery delays, re-declarations, or customs inspections, and even risk losing customers. However, reliable freight companies are limited, and they may also impose additional charges on cargo owners, leaving many with no choice but to reluctantly accept.

Currently, freight rates on multiple global routes are skyrocketing. For instance, freight rates from Asia to certain destinations in Latin America have surged from over $2,000 per 40FT container to $9,000-$10,000, while rates on routes to Europe and North America are also rising rapidly. Companies like CMA CGM have capitalized on this trend by raising their prices.

With maritime demand continuing to rise and freight rates yet to decrease, it’s crucial for manufacturers to stay abreast of the latest developments and plan ahead when shipping yours’ goods.