“Boxes Are Simply Unavailable!” and a New Wave of Price Increases on June 1st

As time passes, the impact of the situation in the Red Sea on detours is continuously manifesting. Recently, container shipping rates have once again soared, with freight forwarding companies universally reporting a severe ‘shortage of containers’ issue. ‘Prices are rising again, and it’s impossible to secure containers!‘ remarked a head of a freight forwarding company, indicating that this ‘container shortage’ essentially stems from a lack of vessel space.

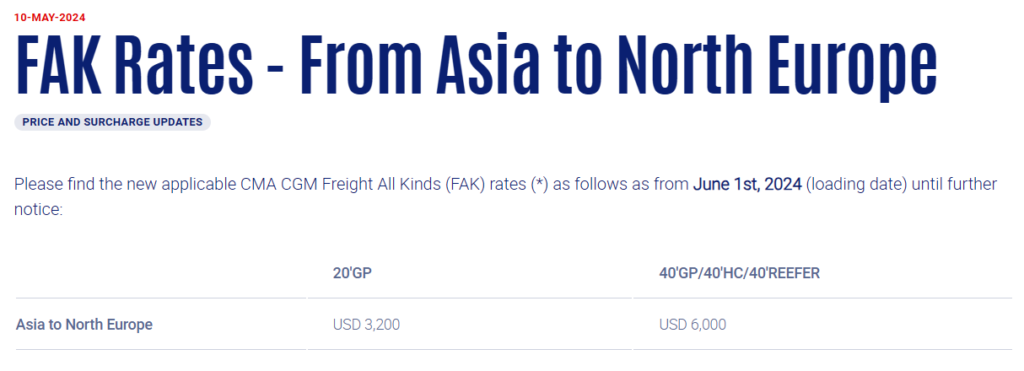

On the basis of the two rounds of price hikes by shipping companies in May, after the ‘May Day’ holiday, liner companies have resumed normal sailings, but container transportation rates continue to rise. In particular, the two shipping giants Maersk and CMA have announced plans for further price increases in June, with an increase in the North Europe FAK rates effective from June 1st. Maersk will charge up to $5900 per 40-foot container, while CMA, on top of the $1500 increase announced on the 15th, will raise the rate by an additional $1000 to $6000 per 40-foot container.

In addition, Maersk will impose a South America Eastbound Peak Season Surcharge starting from June 1st, with a levy of $2000 per 40-foot container.

Market analysts point out that there is currently limited idle capacity in the market, especially against the backdrop of detours in the Red Sea. The current capacity appears relatively insufficient, and the detour effect is becoming increasingly apparent.

From the current performance of spot freight rates, the Shanghai to Rotterdam route in the European line had a significant increase in pricing, with a range of $4040-5554 per FEU reported by liner companies on May 10th, compared to the range of $2932-3885 per FEU reported on April 1st. Similarly, in the American line, freight rates from Shanghai to Los Angeles and Long Beach ports also saw a substantial increase, with the highest quoted price reaching $6457 per FEU on May 10th.

The current status and trend of freight rates in May!

SCFI: On Friday, the Shanghai Containerized Freight Index (SCFI) surged significantly by 18.82%, marking the fifth consecutive week of upward momentum. Across major routes to Europe and North America, rates soared by approximately 20%, with European routes particularly prominent at nearly 25%, registering the highest increase for the week.

WCI: According to data from Drewry’s World Container Index (WCI) on Thursday, rates for European routes surged by 20%, while Mediterranean and US East Coast routes both rose by 16%, and US West Coast routes increased by 18%.

NCFI: On the 10th, data from the Ningbo Containerized Freight Index (NCFI) revealed a 13.3% increase in its composite index for the week. Among them, the index for European routes witnessed the most significant surge at 22.9%, with West Mediterranean routes also rising by 23.5%. Additionally, there were substantial fluctuations in the index for East African routes, with a staggering 47.5% increase. Meanwhile, the index for US East Coast and US West Coast routes rose by 3.6% and 5.8%, respectively.

Analysts at the Ningbo Shipping Exchange attribute the rise in market rates to the widespread implementation of rate hikes by liner companies. On several routes, the market rates have increased as a result. Moreover, the demand for transportation on North American routes has continued to rebound. While liner companies proactively raising prices is one factor contributing to the rate hikes, it’s not the sole reason. Additionally, detours and increased voyage times due to vessels circumventing certain areas have led to decreased fleet turnover rates. Liner companies have had to reallocate vessels or suspend services to maintain operational efficiency.

Meanwhile, COSCO Shipping Holdings has publicly stated that all operations are normal, with full loads on European and American export routes. According to the latest market report from Kuehne Nagel, the world’s largest freight forwarding company, European route capacity remains tight in May, with rates expected to continue rising over the next two weeks. Regarding American routes, the loading rate has been consistently high in the first half of the month, especially on the US West Coast, where the availability of low-cost and FAK space is limited, and tight space situations are expected to persist into the latter half of the month.

According to industry insiders, there has been a significant resurgence in shipping volumes in May. Especially after the end of the May Day holiday, there has been a surge in demand for containers on North American routes, leading to tight capacity and a situation where it’s challenging to secure containers. Several well-known shipping companies have announced that they will impose additional surcharges in May. Currently, it’s known that CMA, COSCO, ZIM, and Evergreen plan to charge an additional $2000 per 20-foot container, while Yang Ming and Ocean Network Express (ONE) have notified customers of an additional charge of $1000 per container.

Maersk: Capacity on Asia-Europe routes reduced by nearly 20%, costs increased, leading to rising freight rates.

Data from the shipping consultancy firm Sea-Intelligence indicates that in the first quarter of this year, the on-time performance of Danish shipping giant Maersk dropped significantly from 65.1% in the fourth quarter of 2023 to 49%.

Maersk Group’s CEO, Søren Skou, explained during a first-quarter earnings press conference that the decline in on-time performance was primarily due to fewer new vessels ordered by Maersk compared to competitors. This made it more challenging to compensate for the long sailing losses incurred due to detours. Skou emphasized that in order to continue providing scheduled services to customers, they must find additional vessels to fill the capacity gap resulting from longer distances.

In order to protect the safety of crew, vessels, and cargo, Maersk has decided to continue opting for the route around the Cape of Good Hope. The company believes this choice is necessary due to the expanded “risk areas spreading into more distant waters.” However, this has also resulted in vessels needing to travel further, increasing both the time and cost required to transport goods to their destinations.

Furthermore, due to a series of chain reactions including vessel congestion, delays, equipment shortages, and capacity constraints, Maersk estimates that industry-wide capacity from the Far East to the North European and Mediterranean markets will decrease by 15% to 20% in the second quarter. To address this challenge, Maersk is enhancing reliability by increasing sailing speeds and capacity. They have also leased an additional 125,000 containers.

Maersk stated that these additional charges are intended to offset the longer voyages, higher sailing speeds, and additional fuel costs. For example, fuel usage per voyage has increased by 40%, and charter rates are three times higher, with typical leases lasting five years.

Skou also mentioned during the conference that Maersk will continue cost control measures to mitigate the additional costs incurred by disruptions in the shipping industry, while enhancing the profitability of its logistics and services business. He acknowledged that “overcapacity remains a challenge and will eventually materialize,” but anticipated that its impact would be delayed.